Futa 940 Form 2025

Futa 940 Form 2025. What this means is that in january,. As a result, employers in california are subject to a futa credit reduction of 0.6% for 2025, and employers are required to pay more in futa taxes that will be.

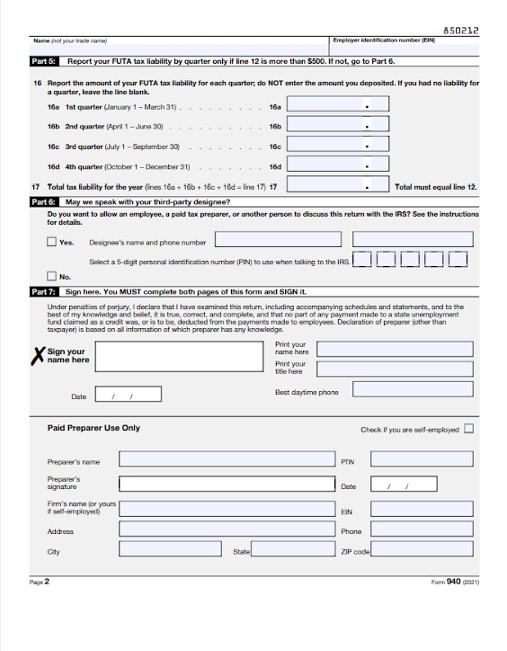

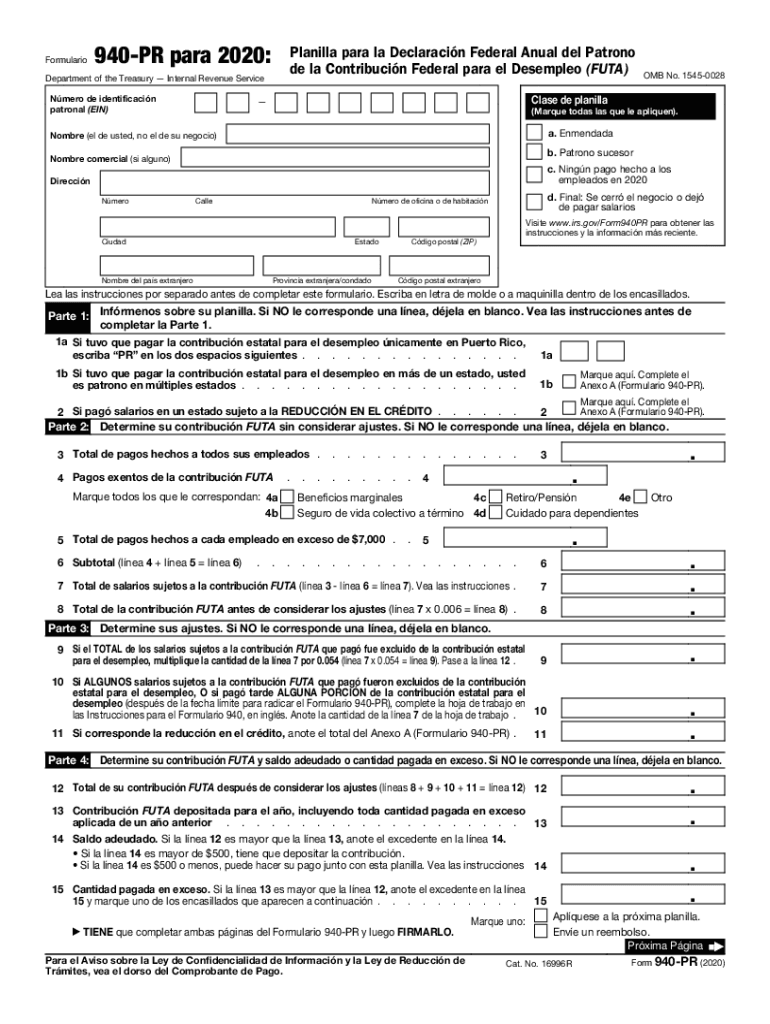

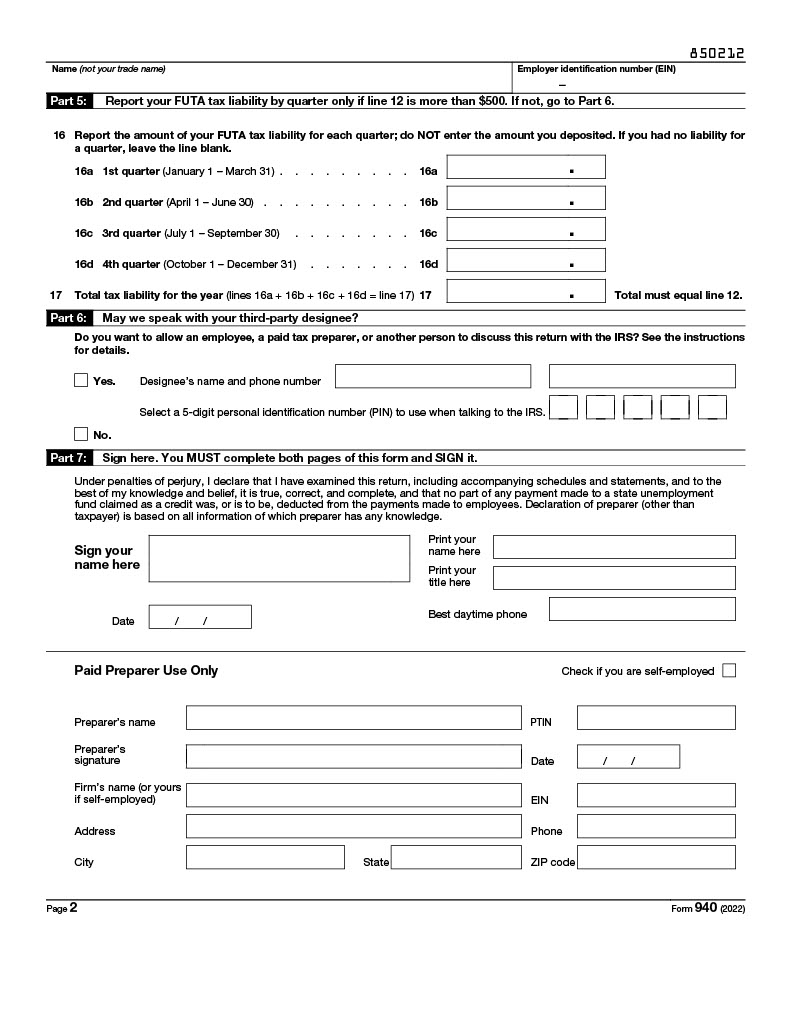

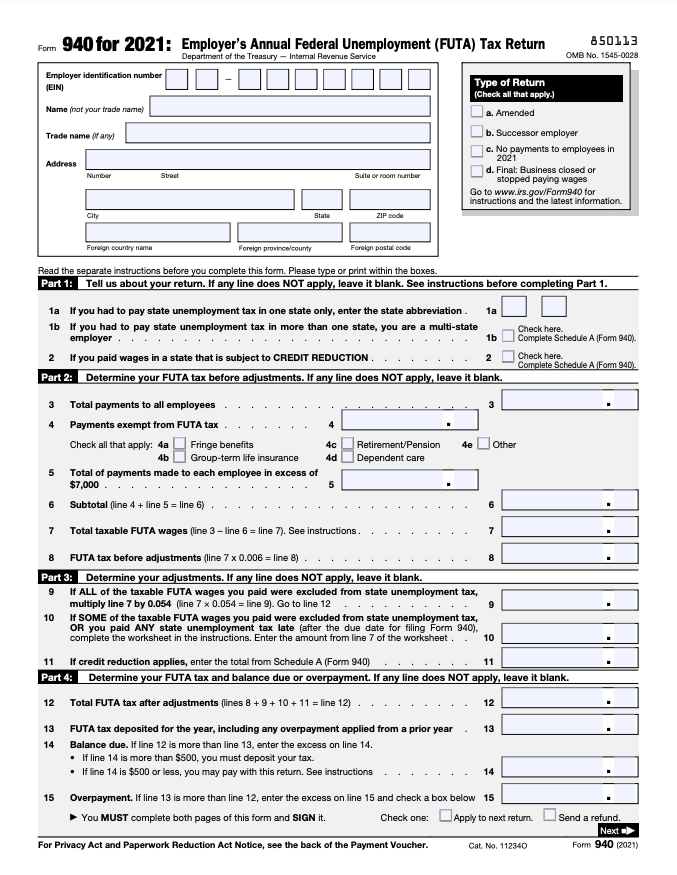

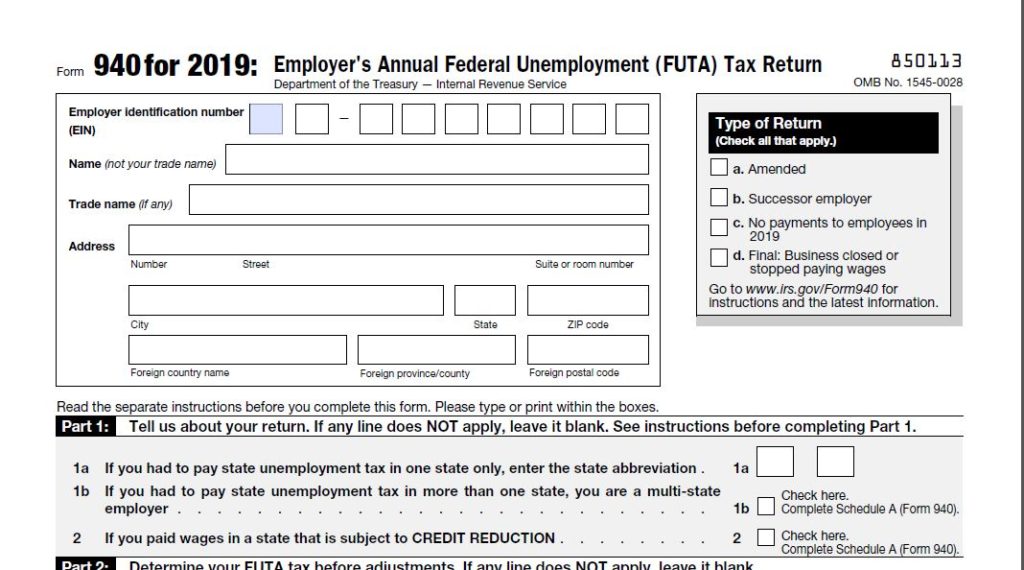

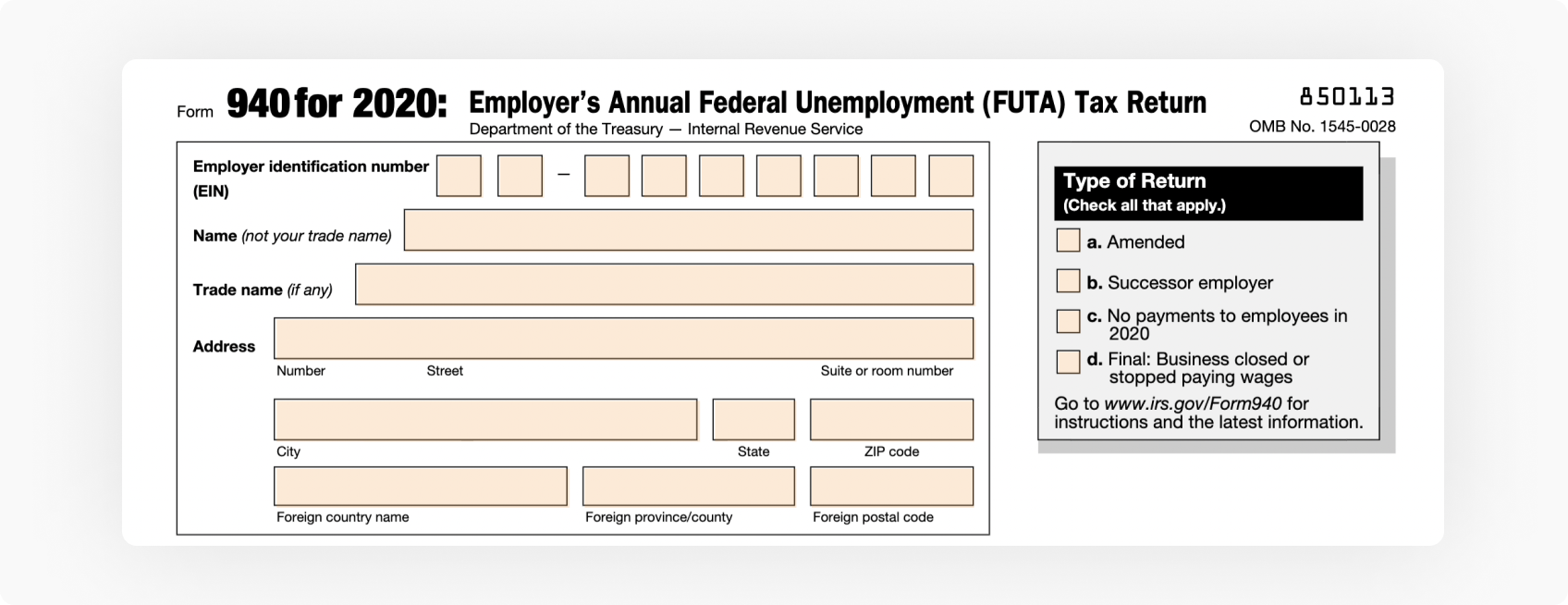

Pr 20202024 Form Fill Out and Sign Printable PDF Template signNow, Form 940 is due by jan. As the deadline to turn in form 940 and deposit futa tax for 2025 approaches, paycheckcity wants to make sure you know how the deadlines can.

Futa 940 Fillable Form Printable Forms Free Online, What this means is that in january,. California employers are expected to pay the adjusted net futa tax rate for 2025 retroactively for the year by january 31, 2025.

940 Form 2025 Printable, FUTA Tax Return, January 16, 2025 11:01 pm. As the deadline to turn in form 940 and deposit futa tax for 2025 approaches, paycheckcity wants to make sure you know how the deadlines can.

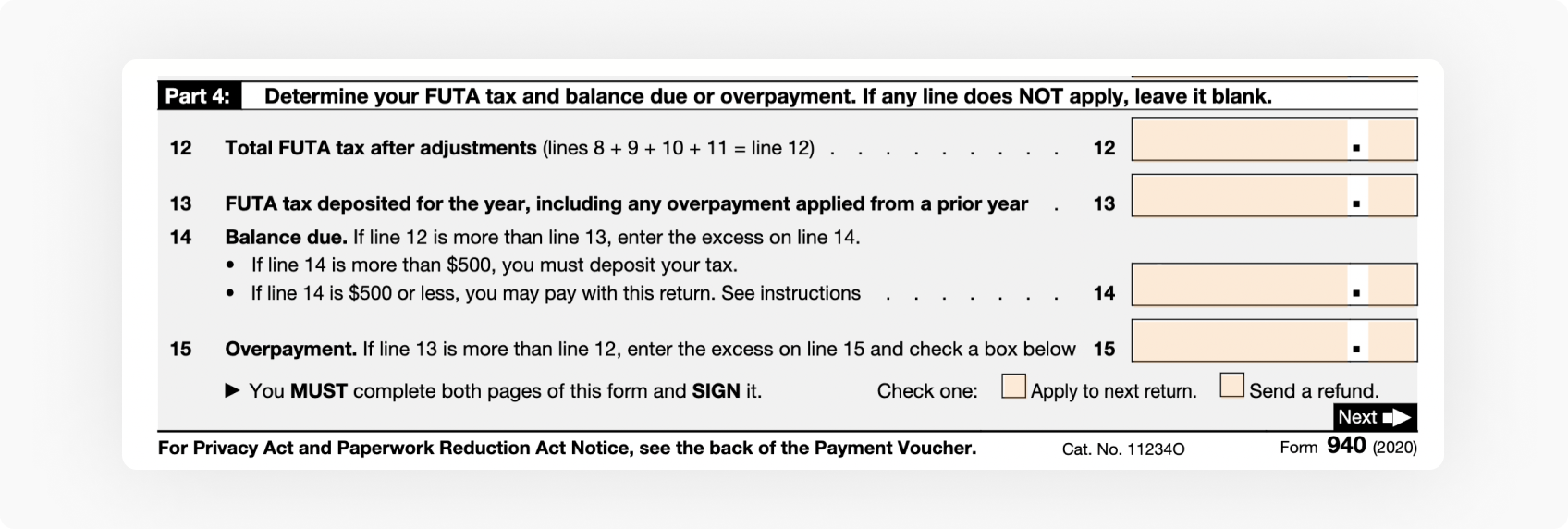

Form 940 When and How to File Your FUTA Tax Return Bench Accounting, Form 940 is a tax form that allows employers to report their annual futa (federal unemployment tax act) payroll tax. Navigating tax forms can be daunting, especially when dealing with.

How to File Form 940 FUTA Employer’s Annual Federal Unemployment Tax, The 2025 tax year's form 940 submission date to the irs is january 31 st, 2025. January 31, 2025 (for the fourth quarter of 2025) april 30, 2025 (for the first quarter of 2025) july 31, 2025;

FUTA Taxes & Form 940 Instructions, Form 940 is due by jan. In new jersey, where no credit reduction exists, the effective futa tax rate is 0.6% for.

form940instructionsfutataxrate202101 pdfFiller Blog, As the deadline to turn in form 940 and deposit futa tax for 2025 approaches, paycheckcity wants to make sure you know how the deadlines can. Form 940 is due by jan.

Fillable Form 940 For 2025 Fillable Form 2025, Form 940 is a tax form that allows employers to report their annual futa (federal unemployment tax act) payroll tax. Don’t forget about futa taxes

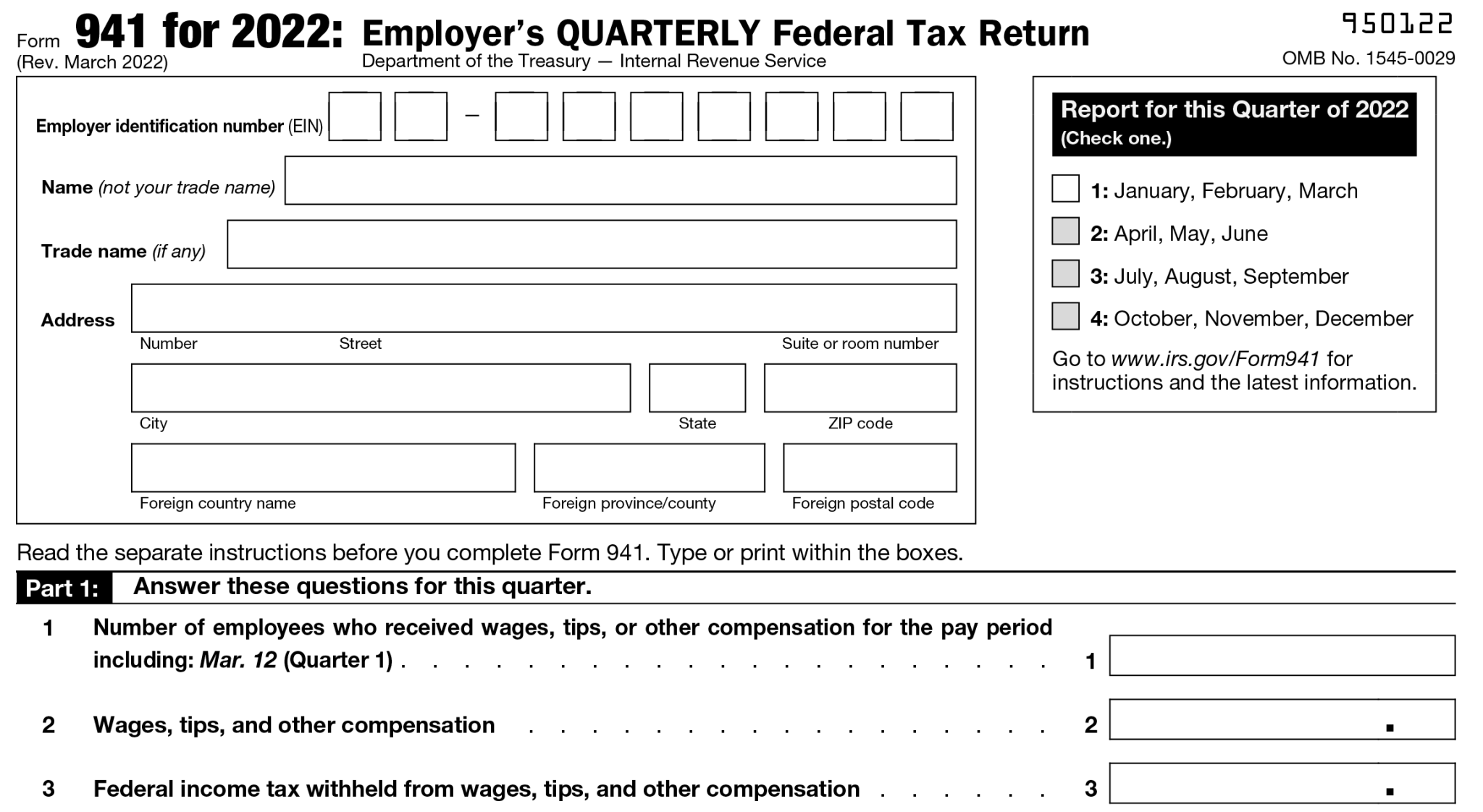

form940instructionsfutataxrate202105 pdfFiller Blog, Businesses also have to report futa taxes as part of their annual tax return, filed using irs form 940. January 16, 2025 11:01 pm.

940 Form 2025 Printable Forms Free Online, Most employers typically receive a 5.4% futa tax credit reduction when filing their form 940 (employer’s annual federal unemployment (futa) tax return). The credit and reduced rate are available by filing the form 940 for 2025.

Businesses also have to report futa taxes as part of their annual tax return, filed using irs form 940.